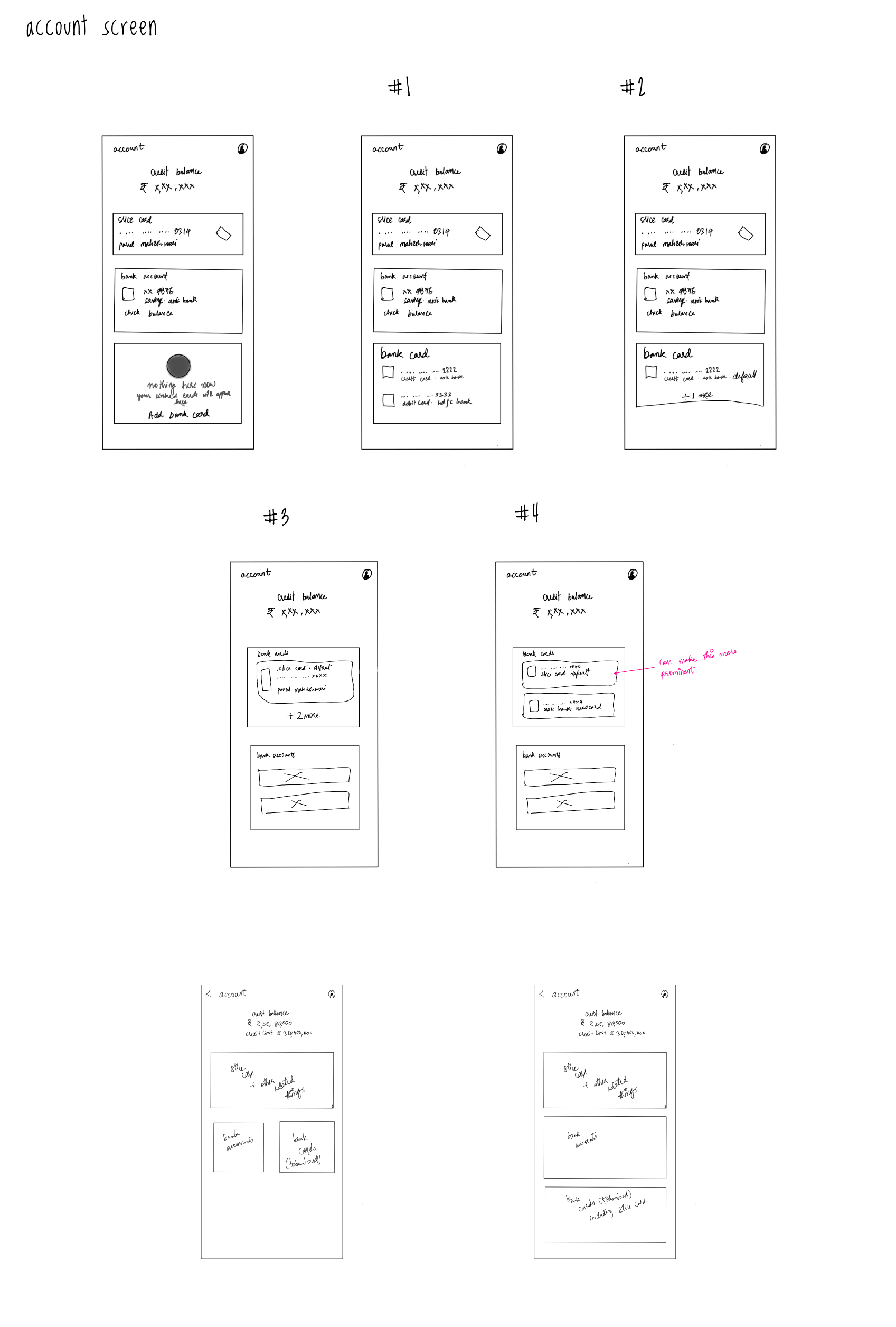

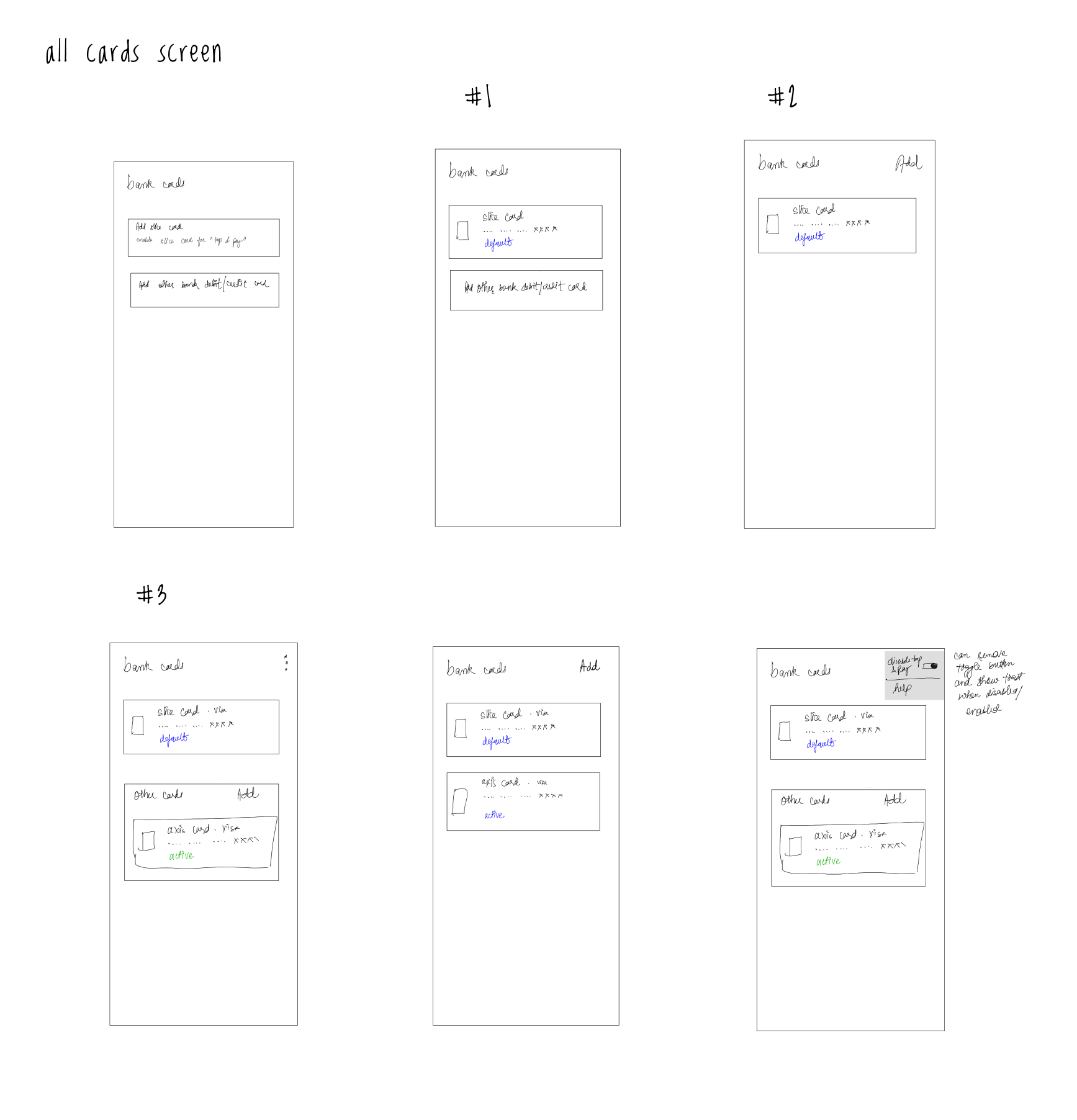

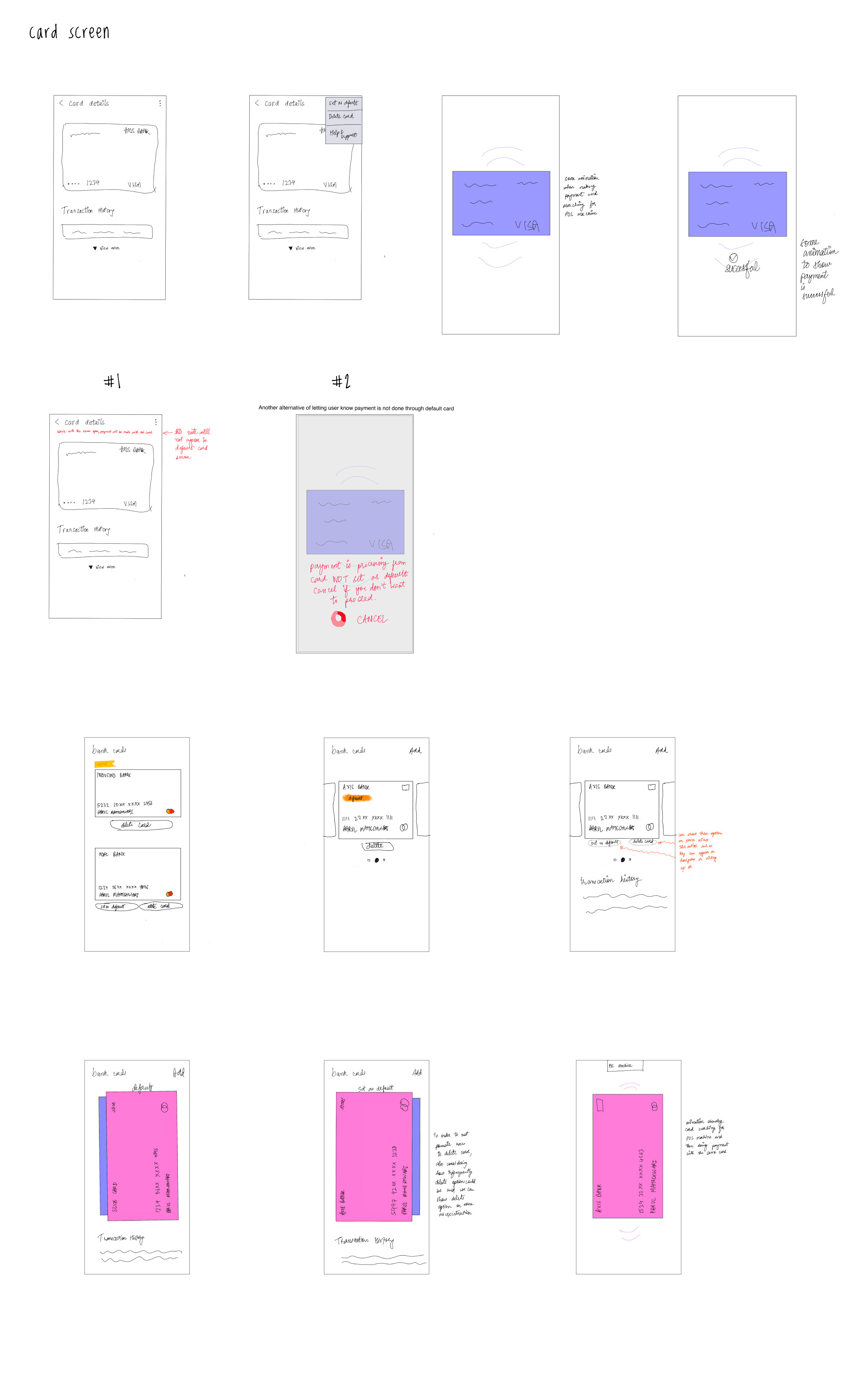

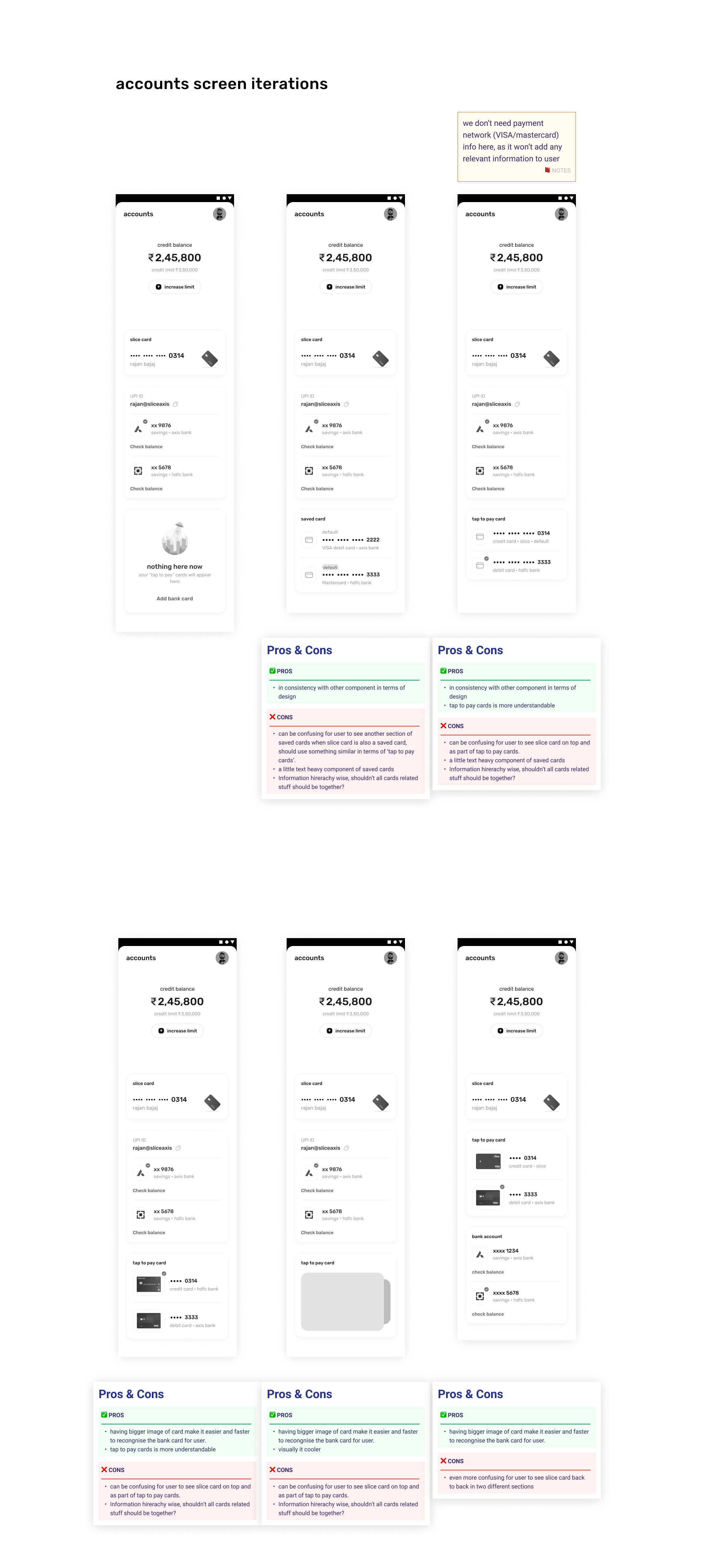

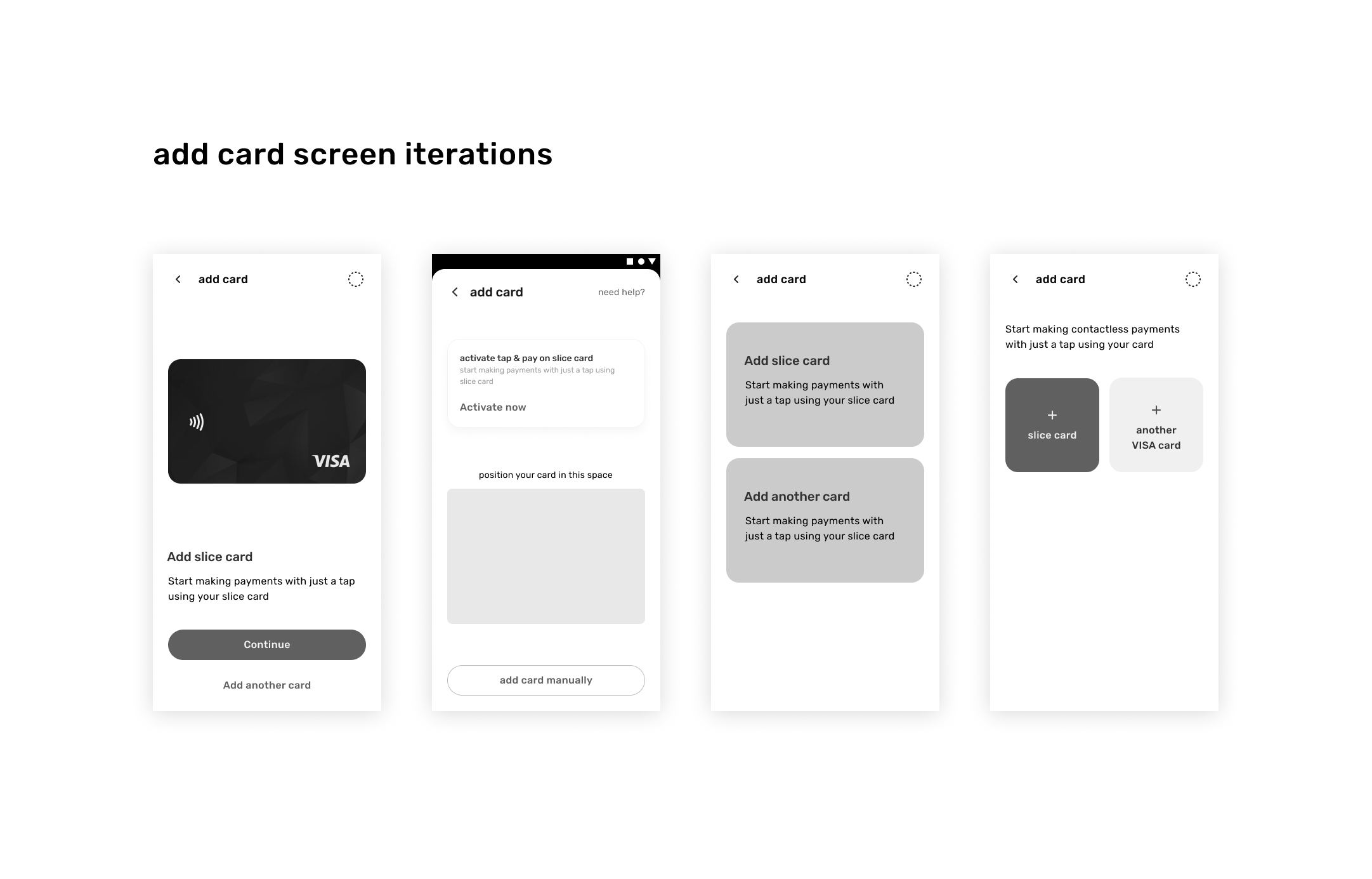

After multiple rounds of wireframe and user interface iterations, we finalised below designs. This is just a part of prototype to give idea of final designs, but the interactions, illustrations, and microcopy is still not final in here. It has to go through respective teams before freezing the designs.

You can view the final designs on below link -

Contactless Payment figma file