What we did well

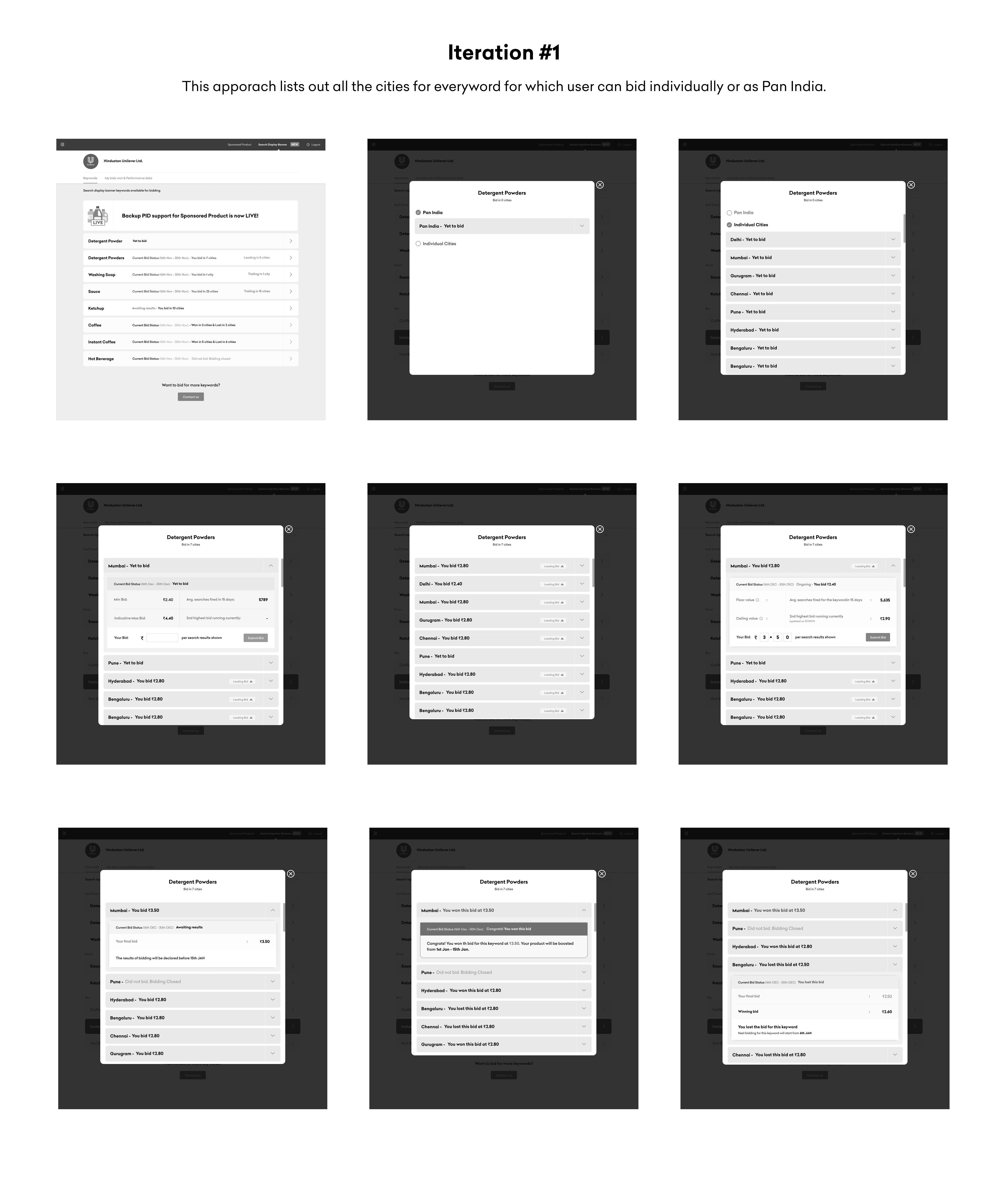

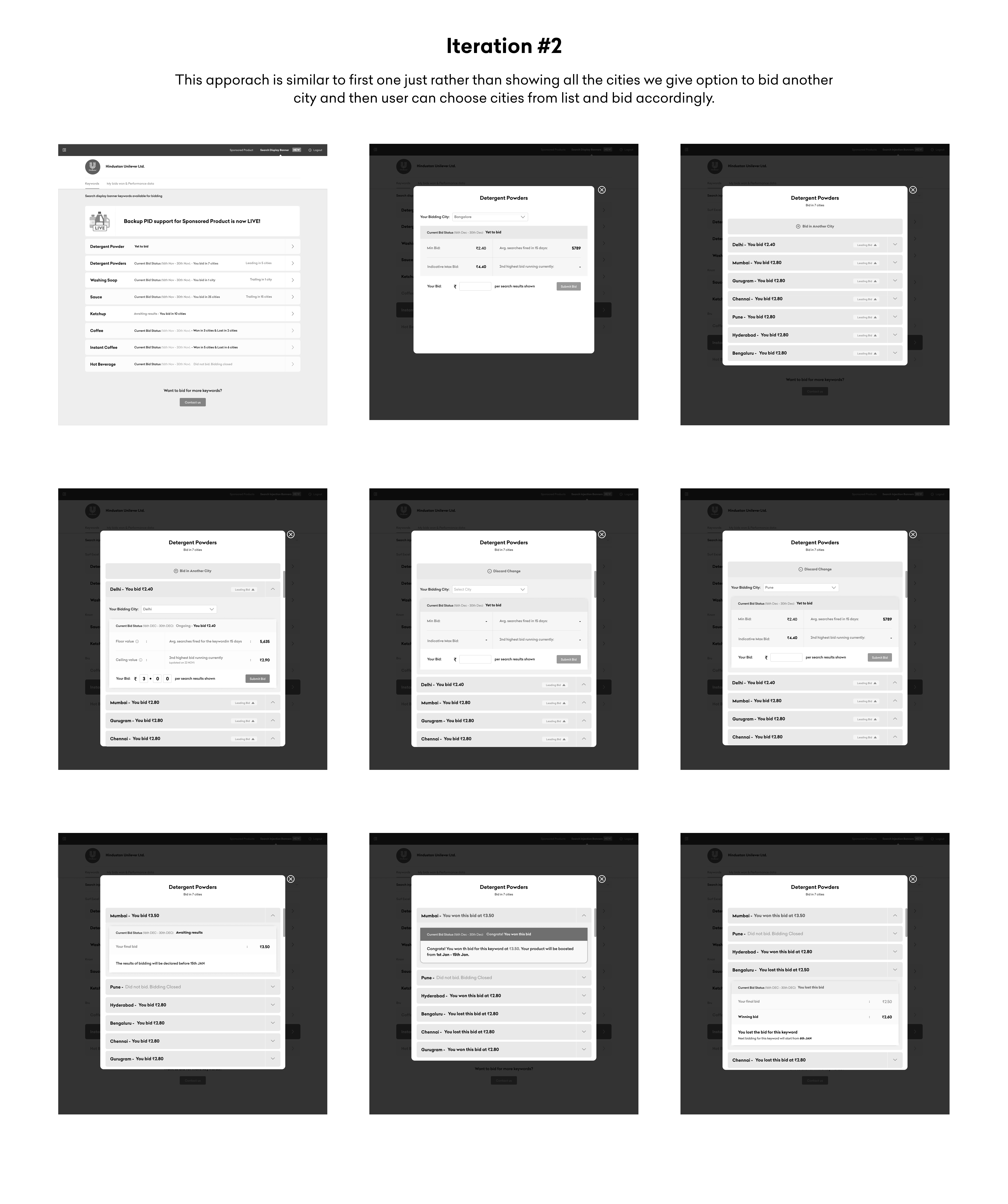

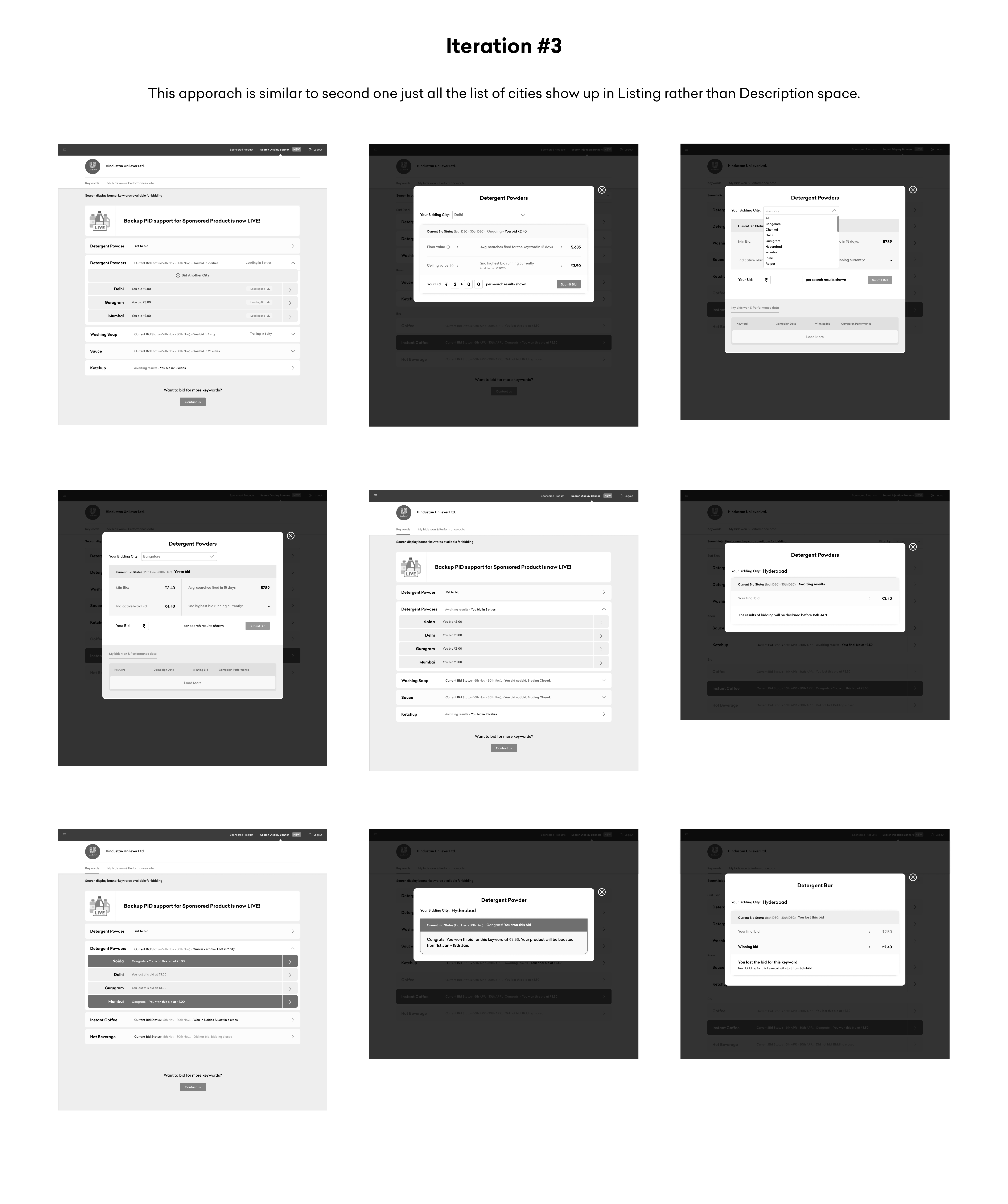

As a group (me and my Monetisation teammates) we feel that we were successful in developing and implementing a bidding system that allows users to explore city-level as well as PAN-India level bidding. We used the similar visualisation we already had to make user experience easier.

We considered minute things that could create a larger impact on users. For example, we knew our users don't have much time while bidding and every minute counts for them so we kept the city list open and also removed some extra redundant information. We also kept an option to bid through csv files as we knew our users are very comfortable with excel sheets. All these things came out while user testing, we feel that our process was able to define the issue and give us time to address it properly, which would label this change a success.

What could be done differently

An area where we feel we were not entirely successful was helping users guide the city to bid in. While exploring other platforms we realised their systems have algorithms to take care of city-wise bidding internally. Additional exploration in this direction was deprioritised due to time constraints. But, this could have been a very interesting addition.